Asset Alchemy™: Hybrid Bitcoin Property Investment Formula

Asset Alchemy Formula : Hybrid Bitcoin Property Investment Stratgey

The “Asset Alchemy” formula, mentioned by a property expert Cenap Turgut and Bitcoin supporter, is a strategy for young and smart investors, first time property buyers, creators, entrepreneurs, and digital nomads. to build wealth by combining cryptocurrency, particularly Bitcoin, with real estate. It involves using Bitcoin profits to purchase off-plan properties, where only a portion (25-40%) is paid upfront, and the rest is due later, often 2-3 years after purchase. During this period, Bitcoin’s value is expected to grow, allowing investors to use this increase to cover the remaining property cost, turning digital savings into physical assets.

### Sample Calculation Breakdown

For the given example:

– **Property Details**: A 1-bedroom off-plan property costs $200,000, with a 25% down payment ($50,000) paid now, and the remaining $150,000 due in 2 years.

– **Bitcoin Investment**: The investor starts stacking Bitcoin monthly from a minimum of $5,000, investing $5,000 per month for 24 months, totaling $120,000 invested over 2 years.

– **Assumptions**:

– Bitcoin grows at an average annual rate of 57.5% (based on historical data over the last 10 years).

– Property appreciates at 9.5% annually (midpoint of 7-12% if well-chosen).

– Gold, for diversification, has an average annual growth of 11% over the last 10 years.

Using these assumptions:

– After 2 years, with 57.5% annual growth, the Bitcoin investment could grow to approximately $200,000, allowing the investor to cover the $150,000 final payment and have $50,000 left in Bitcoin.

– The property, initially $200,000, would appreciate to about $239,600 after 2 years at 9.5% annually.

– Total assets at the end would be the property ($239,600) plus remaining Bitcoin ($50,000), totaling $289,600, against an initial outlay of $170,000 (down payment $50,000 + Bitcoin investments $120,000), yielding a gain of $119,600.

However, if Bitcoin grows at a lower rate, say 5% annually, the Bitcoin value might be around $130,000, insufficient to cover the $150,000, requiring an additional $20,000, possibly from other savings or a mortgage.

### Risk Mitigation with Diversification

To lower risk, investing 60% in Bitcoin and 40% in gold is suggested. For example, with total savings of $300,000:

– Bitcoin investment: $180,000 (60%), gold investment: $120,000 (40%).

– After 2 years, gold at 11% growth would be worth about $148,000.

– If Bitcoin grows at 57.5%, it’s worth around $300,000, covering payments with surplus; if at 5%, around $195,000, still covering but tighter, and gold provides a buffer for unexpected shortfalls.

### Survey Note: Detailed Analysis of the “Asset Alchemy” Strategy

The “Asset Alchemy” formula, purportedly first mentioned by Cenap Turgut, a property expert and Bitcoin supporter, is a wealth-building strategy that integrates cryptocurrency, specifically Bitcoin, with real estate investments. This approach is tailored for young investors, creators, entrepreneurs, and digital nomads, aiming to leverage the high growth potential of Bitcoin to fund the purchase of off-plan real estate properties. Off-plan properties are those purchased before completion, often requiring a partial payment upfront (typically 25-40%) with the remainder due later, usually 2-3 years after the initial purchase. The strategy hinges on the appreciation of Bitcoin during this period to cover the final payment, effectively transforming digital assets into tangible real estate.

#### Strategy Overview

The core idea is to use profits from Bitcoin investments to finance real estate purchases. For instance, an investor might use the gains from their Bitcoin holdings to make a down payment on an off-plan property and then rely on further Bitcoin appreciation to settle the remaining balance. This method is presented as a way to convert volatile digital savings into long-term, stable physical assets. However, the strategy carries risks, particularly given Bitcoin’s price volatility. If Bitcoin’s value drops at the time of the final payment, investors might need additional funds or resort to obtaining a mortgage to cover the shortfall. The strategy mitigates this by suggesting diversification, with 60% of savings allocated to Bitcoin and 40% to gold, leveraging Bitcoin’s historical average annual growth of 57.5% over the last 10 years and gold’s 11% annual gain during the same period.

#### Detailed Sample Calculation

To illustrate, consider the provided example: a 1-bedroom off-plan property costing $200,000, with a 25% down payment ($50,000) paid now, and the remaining $150,000 due in 2 years. The investor also starts stacking Bitcoin monthly from a minimum of $5,000, investing $5,000 per month for 24 months, totaling $120,000 invested over 2 years. Additional assumptions include Bitcoin’s growth at 57.5% annually, property appreciation at 9.5% annually (midpoint of 7-12% if well-chosen), and gold’s growth at 11% annually for diversification analysis.

##### Bitcoin Value Calculation

The Bitcoin investment involves dollar-cost averaging, with $5,000 invested monthly for 24 months. Assuming exponential growth at 57.5% annually, the price of Bitcoin at month \(t\) is modeled as \(P(t) = P_{\text{now}} \times (1.575)^{t/12}\), where \(t\) is in months. The total value at 2 years (24 months) is calculated as the sum of each monthly investment’s value at that time, adjusted for growth. This results in an approximate value of $200,000, allowing the investor to cover the $150,000 final payment and retain $50,000 in Bitcoin value after the sale.

##### Property Value Calculation

The property, initially costing $200,000, appreciates at 9.5% annually. After 2 years, its value is calculated as \(200,000 \times (1.095)^2 \approx 200,000 \times 1.198 \approx 239,600\). Thus, the property’s market value at the end of 2 years is approximately $239,600.

##### Final Payment and Asset Balance

With Bitcoin valued at $200,000 after 2 years, the investor can sell part worth $150,000 to cover the final payment, leaving $50,000 in Bitcoin. Their total assets include the property worth $239,600 and remaining Bitcoin worth $50,000, totaling $289,600. The initial outlay was $170,000 ($50,000 down payment + $120,000 Bitcoin investments), resulting in a gain of $119,600.

##### Sensitivity Analysis: Lower Bitcoin Growth

If Bitcoin grows at a lower rate, say 5% annually, the calculation adjusts similarly, yielding a Bitcoin value of approximately $130,000, insufficient to cover the $150,000 final payment, requiring an additional $20,000. This highlights the strategy’s dependence on Bitcoin’s performance, necessitating contingency plans like additional savings or mortgages.

#### Risk Mitigation with Diversification

To mitigate risks, the strategy suggests allocating 60% of savings to Bitcoin and 40% to gold. Assuming total savings of $300,000 for illustration:

– Bitcoin investment: $180,000 (60%), gold investment: $120,000 (40%).

– Gold, growing at 11% annually, would be worth \(120,000 \times (1.11)^2 \approx 120,000 \times 1.2321 \approx 148,052\) after 2 years.

– In the base case (57.5% Bitcoin growth), Bitcoin value is around $300,000, covering payments with surplus. In the lower case (5% growth, $195,000 Bitcoin value), the investor might need to sell part of gold (worth $148,052) to cover any shortfall, enhancing resilience.

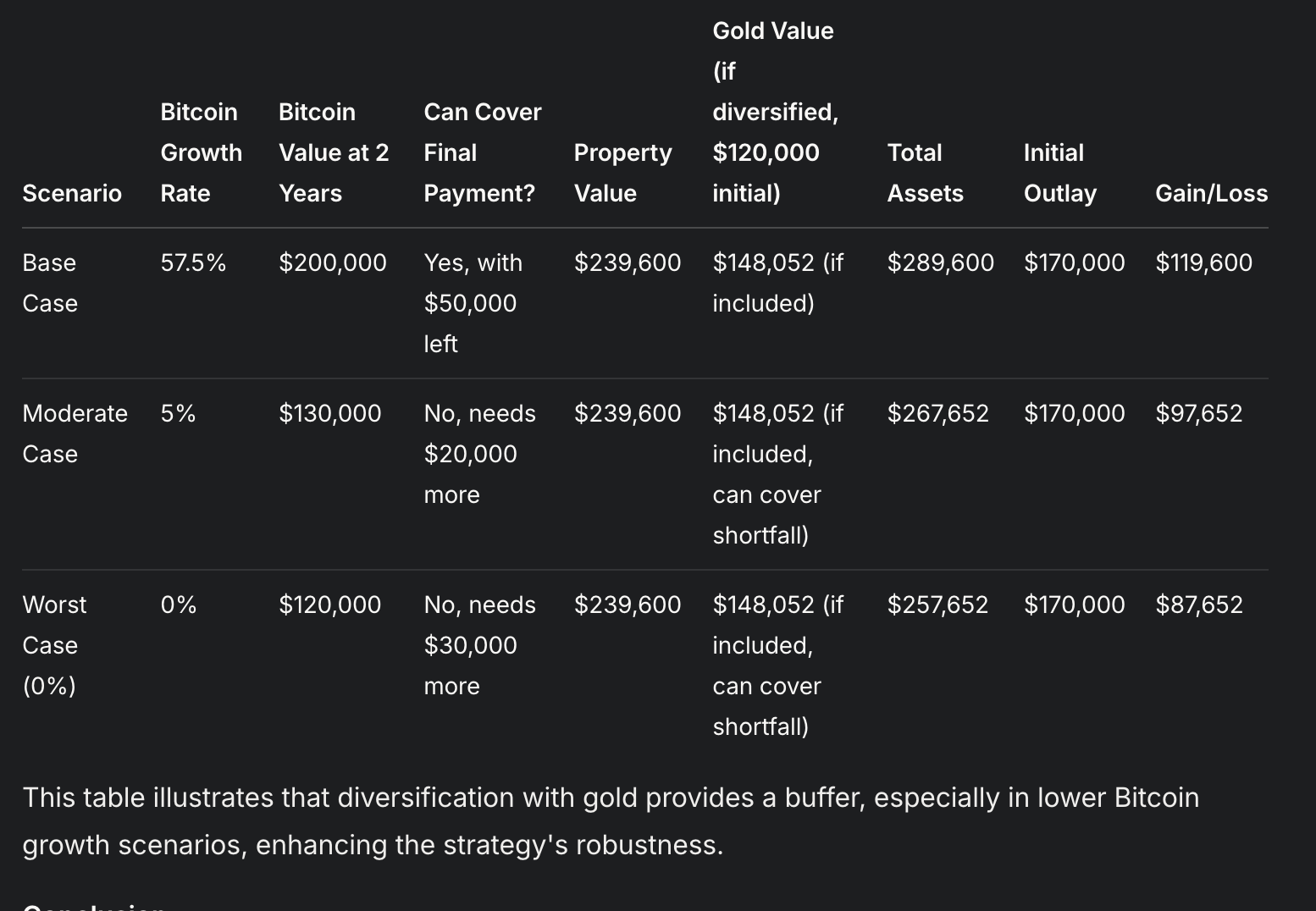

Comparative Scenarios

The following table summarizes the outcomes under different Bitcoin growth rates, with and without gold diversification:

#### Conclusion

The “Asset Alchemy” strategy offers a potentially lucrative way to build wealth by leveraging Bitcoin’s growth for real estate investments, with significant returns under favorable conditions. However, its success hinges on Bitcoin’s performance.

Diversification with gold (60% Bitcoin, 40% gold) can mitigate risks, particularly in volatile markets. Investors should carefully assess their risk tolerance and consider contingency plans, such as additional savings or mortgages, to manage potential shortfalls.